Oregon offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

Renewable Portfolio Standard

Oregon’s Renewable Energy

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

Oregon Government

900 Court St. NE

Salem, OR 97301

(503) 986-1388

[email protected]

Hours: M-F 8:00am – 5:00pm

Portland General Electric

121 Sw Salmon St.

Portland, Oregon, 97204

(503) 228-6322

[email protected]

Hours: M-F 7:00am-7:00pm

Oregon Department of Energy

550 Capitol St. NE, 1st Floor

Salem, OR 97301

(503) 378-4040

[email protected]

Hours: M-F 8:00am – 5:00pm

Portland Weather Bureau

5241 NE 122nd Avenue Portland, OR 97230-1089

(503) 261-9246

[email protected]

Open Daily, 24 hours

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

New York Clean Energy Power

Clean Vehicle

Oregon Solar + Storage Rebate Program

Energy Assistance Programs

Contact

Solar for All

Recent Federal Investments in Energy and Climate

Energy Efficiency Standards: Appliances and Other Products

Power Outage Map

Oregon Department of Administrative Services

Phone: 503-378-5797

X (Twitter): @OregonDAS

DAS Programs

DAS Services

Labor & Industries Building

155 Cottage Street NE

Salem, OR 97301-3972

Oregon Solar Credits Overview

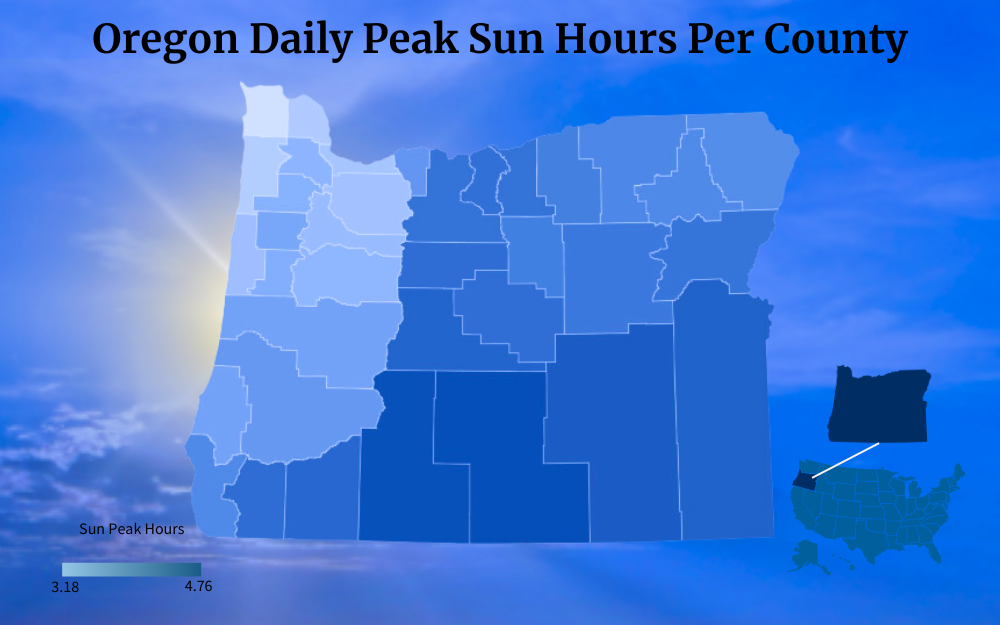

Oregon solar incentives play a significant role in the state’s approach to renewable energy. You would think that an average of 191 sunny days in Oregon and 144 in one of its major cities would mean that the state is doing badly when it comes to solar power.

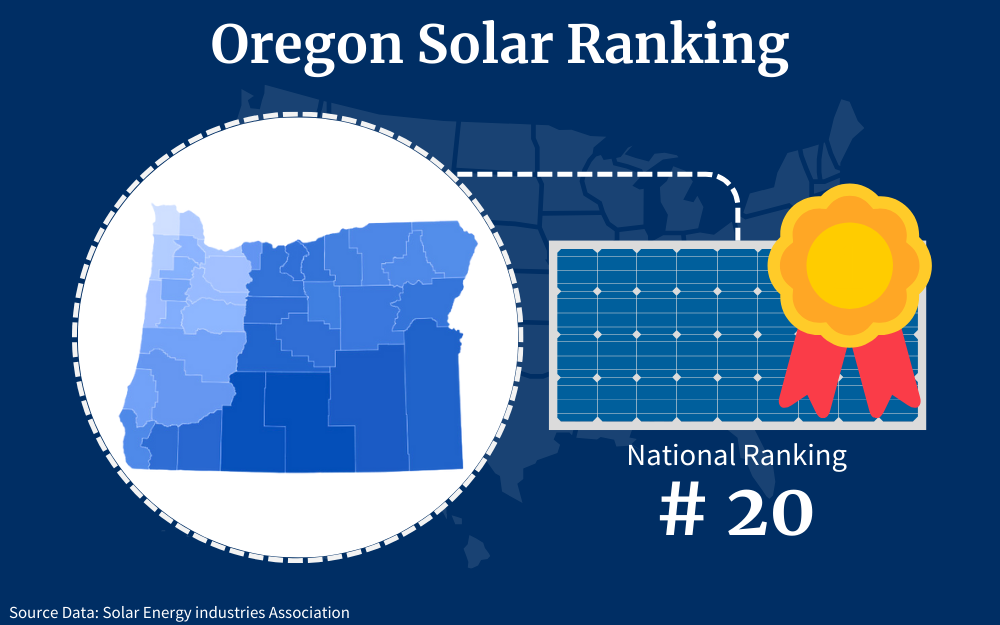

However, it’s ranks as 20th in the nation for solar implementation, and recent incentives allow homeowners to register for a number of credits and renewable energy programs and rebates.

In fact, anyone can register for Oregon solar incentives after meeting the state’s requirements and conditions.

This guide explains the federal solar tax credit, how it works, how to apply for it, and the eligibility criteria for residents in Oregon who want to install a home solar system, as well as a number of cash back rebates and protections you can enroll for to reduce the cost of solar panels in Oregon.

If you are living in Oregon and keep worrying that the cost of solar may be too high for you, you will be excited to learn that it doesn’t have to be; that there is a federal solar tax credit here to help ease that burden. This incentive has been a total game changer in the solar market, not just in Oregon but also in the entire country since its creation all the way in 2005.

But what is it all about? Even before delving into the eligibility criteria.

The federal solar tax credit is a nationwide incentive that was created to encourage more people to embrace renewable energy, whether wind, solar, or geothermal. It has a very simple working principle, reducing the cost of going green by 30%, and that amount is reflected through a tax relief.

So, in this case, you are able to claim 30% in terms of the solar tax credit and have it deducted from the amount of taxes that you owe in the year of application.

There are instances where the tax liability doesn’t fully cater for the 30%, and as such, the balance will be carried over to the next year, and this can happen all over again for a maximum of five years.1

One question that many homeowners ask is what happens when the tax credit is higher than the amount of taxes that they owe. The tax credit is usually non-refundable but there are instances where you as a homeowner will be able to get a tax refund after the tax credit.

This happens if the reduction in your tax liability means that there was an overpayment in that particular year, say if your employer reduced your taxes as an employee in that same year.

So, how long will it take to get my rebate? The tax refund could be awarded to you by the end of that same year, but on the other hand, if you have a surplus in terms of tax credits, it will easily be carried over to the other tax year.6

Renewable Solar Energy Credits From the Government

There is more good news for Oregonians, that apart from the federal solar tax credit, there are also more rebate programs and local incentives that you can take full advantage of. You could actually end up saving more than 30% that you were hoping for, and that is really great news if the price point of solar panels was the main hurdle in your way of converting to solar.

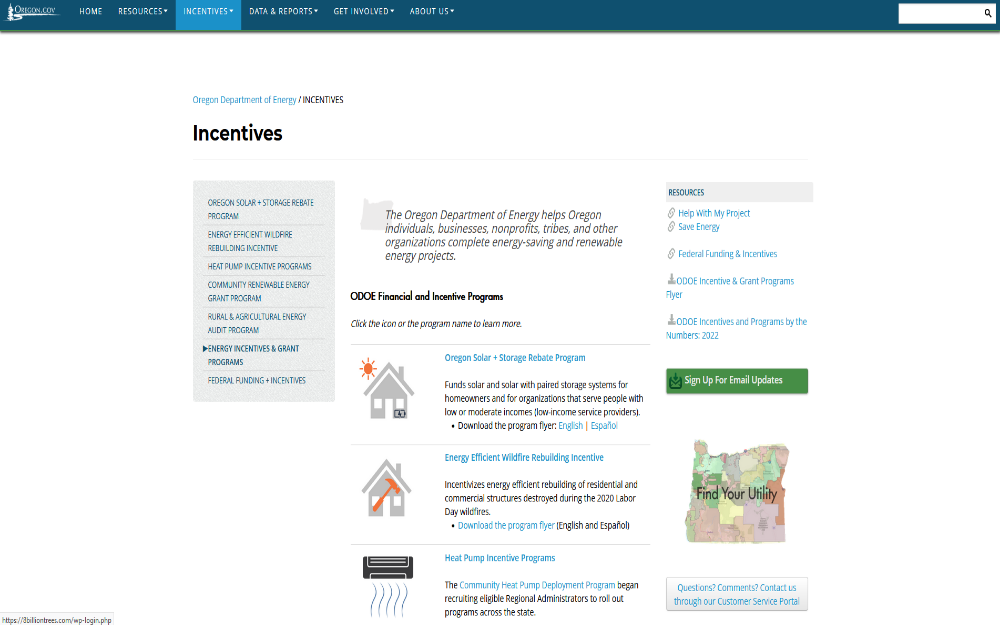

Oregon Solar and Storage Rebate Program

This is a solar stimulus program that is actually being offered by the Oregon Department of Energy and it is one of the most lucrative ways that you can use to cut the cost of your solar panels.7

So how does it really work?

Did you know that you can save up to $5,000 when buying your Oregon solar panels? This is the maximum amount that the incentive offers and imagine what that would mean if paired with the solar tax credit.

That’s not even all; you are also able to use this program to claim $2,500 on your solar energy storage system equipment, which technically brings the total to $7,500. It usually works by giving a certain amount of money for each and every watt that you have installed depending on your income bracket.

The lowest-income households end up receiving about $1.80 for each watt, while other groups are eligible for $0.20- $0.50.

Oregon Solar Within Reach Program

There is one very enticing program that comes from the Energy Trust of Oregon,13 and the goal is pretty simple: to make sure that there is more access to solar power. This incentive comes in different forms, especially according to your utility company.

For instance, if you are a loyal customer of Portland General Electric,15 you will be able to claim as much as $1.20 for each and every watt that you have installed, or $7,200, whichever is lower. On the other hand, if you are a member of Pacific Power,16 you would be able to receive about $1.00 for every watt that you have installed and the rate can go up to a maximum of $6,000.3

Additional Oregon Renewable Energy Programs and Rebates for Residents

In addition to the Oregon solar incentives listed above, the state offers a number of renewable energy rebates and programs that put cash in your pocket when you make energy efficient upgrades to your home.

These include:

| Oregon Solar Incentive | Rebate Amount | Conditions | Contact |

| City of Ashland Solar Electric (PV) Incentives | Systems installed on the 1st of January 23 onwards: $600

System installed before 1st of January 2023: $0.25/watt, maximum of $5,000 |

|

Download and fill out all forms and go to the Climate & Energy Incentive Programs Online Application page |

| Energy Trust incentives | Portland General Electric and Pacific Power customers could receive:

a) $400/home (PV system) b) $250/kWh with a maximum of $3,000/home |

|

Contact one of the approved contractors in Oregon and they will help you with the process |

| Central Lincoln People’s Utility District Renewable Energy Rebate Programs | Battery storage: Up to $2,000

Solar electric: $500/kWDC, maximum of $2,000 Solar water heater: Maximum of $800/system |

|

Contractors must send all forms and documents via mail or email:

Central Lincoln PUD Email: [email protected] |

How To Qualify for Oregon Solar Rebates and Credits

If you want to get a hold of the federal solar tax credit when installing your home solar energy system, you will want to know the rules and how to properly apply for it.

There are so many homeowners who end up missing out on the lucrative incentive just because of overlooking certain aspects. But the most important thing to remember is that there is absolutely no way you could apply for the tax credit if you have not yet completed the installation; how else will you calculate 30% of the total cost?

Are You Eligible for the Federal Solar Tax Credit?

Here are key points to be aware of if you qualify for the federal solar tax credit:

- Your solar panel system is supposed to be an installation that happened between the first day of 2017 and the last day of 2034 (1 January 2017- 31 December 2034).

- The PV is supposed to be located in your residence in the US.

- You must be the legal owner of the PV system after either paying in cash or financing it, just as long as you are leasing it out from a solar company.

- The installation must be brand-new and in use for the very first time or must be an “original installation.”

How To Claim the Federal Solar Tax Credit

Follow these steps to claim the federal solar tax credit:

Step 1. You can easily claim the Oregon solar tax credit next time you are filing your taxes. As long as you are certain that your system is eligible for the incentive, you can go ahead and start the application process.

Step 2. It all starts with going to the IRS’s official website and scrolling to find the IRS Form 5695,11download it because it is one of the main Solar tax credit forms Oregon that you are going to need to prove that you deserve the credit.

Step 3. You can go ahead and start calculating 30% of the tax credit that you are eligible for, which is 30% multiplied by the total amount of money that you used for the installation.

Step 4. Next, carry on with the calculations on lines 6 (a and b) of the document.

Step 5. Complete the other Form 5695 instructions and calculations in lines 14, 15, and 16.

Step 6. Take whatever results you find in the last lines and fill them out in line 5 of Form 1040.5,14

Step 7. With that, you will be done and can wait for the credit to apply to the amount of taxes that you owe.

Can I Sell Power Back to the Grid?

Net metering is being offered in Oregon and is actually a sought-after incentive.9

One of the advantages of going solar is that you can do a lot with the power that you receive. It will come in handy to run your entire household just the same thing that the traditional grid does, and there are instances where the sunlight intensity is too high that the panels produce way more power than you really need, so what happens in such cases?

How about you sell the surplus to the grid?

NEM in the state is available for all residential solar Oregon installations, just as long as they are at least 25 kW in size. You will find this program very efficient because it is a win-win for both you and your local utility provider.

For you, you will be putting your excess power to good use and, at the same time, receive credits as a reward for your service. It is even more attractive knowing that net metering in Oregon is being awarded at a full retail charge.

What does this really mean? For every single kWh that comes from your system in terms of surplus, you will be able to offset one kWh that you receive back from the grid.2

This is quite admirable of the state because this is not available in many regions, and the utilities get away with offering lower retail rates in exchange for net metering. If you are looking for a way to reduce the payback period of your panels, then this is one way to go.

This is one of the reasons why homeowners are advised to avoid solar leases or free solar panels Oregon if they want to make full use of their solar panels.

If you are looking for how to get free solar panels in the form of PPAs and solar leases, you should know that you will not fully benefit from incentives like net metering. Before enrolling, you will have to get approval from the solar company that had the system installed, and even when you succeed, they will be the ones to enjoy most of the benefits.

Home Solar Installation Expenses and Materials

First things first, what is solar PV? Solar PV basically refers to a group of devices that work together to help transform the rays from the sun into electricity.

It is the job of the photovoltaic cells to ensure that there is a full transformation of sunlight to power, and it is quite an elaborate system that comes with so many other parts.8 When you buy a house solar system, you have to take into consideration that there are also other parts, like the inverters, charge controller, batteries, cables and so many smaller parts.

There are also certain factors that you will have to account for when buying solar panels for house.

Apart from the cost of solar panels in Oregon, you will also consider which type of panel you are going for, the brand, its size, the level of performance, its durability, how compatible it is going to be with your roof, and many more personal considerations. But still, one thing matters a lot, the question of, how much solar panels cost in Oregon.

Well, the average solar panels Oregon cost is around $24,160, and that is basically for an 8 kW system.12 However, if you are going for a smaller and less elaborate setup, it is, of course, going to cost you way less.

This is common, especially in households where there are low energy needs. So, you don’t have to worry that installing solar panels in Oregon will cost you a fortune.

Did you know that you can also learn how to make solar cells, which will bring the budget even way further down and you will still have a working system even without buying brand-new equipment?

Solar Calculator: How Much Can You Save?

Using a solar power calculator may not seem necessary until you realize how handy it is especially for prospective solar panel owners.

There is no better way to get a rough idea of what you are getting into other than by using a solar power home calculator. There are so many of them online coming in various forms and you can always find one to suit your needs.

For instance, a solar panel calculator will have to take some aspects into consideration when helping you determine exactly how many solar panels I need. You will have to disclose details like the size of your home and the average amount of energy that you need.

That is why there is an estimated amount of 20-30 solar panels that are required in order to fully offset the energy needs of a typical home.

You can also use the calculators to help figure out your energy needs or the size of the system that you are going to use. It all starts with obtaining estimates from your annual electricity consumption; it can be in the form of the averages of your yearly monthly utility bills or the average of a typical American household.

You should also be aware of the wattage of each panel and the production ratio and with that, the software would be able to come up with the readings for you.

How To Find OR Solar Panels

Thinking about buying solar panels for homes but have no idea where to start? You are not alone.

There are so many Oregonians like you who want to go solar but are not sure who to contract for the solar installation job. Admittedly, it can be pretty overwhelming, especially given that there are so many solar companies in the region.

So how do you make sure that you get only the best equipment that the solar market has to offer and at the most competitive prices?

The first step is to narrow down the list and you can do that in so many ways. Seek recommendations from people you know, at least this way, you will be contracting the job to people whose work you have seen.

You can also go online to find reviews about the company, and while at it, be very keen on both the good and the bad, because they will give you a clearer picture of what you are getting into.

Narrow down to a few solar power companies with the most glowing reviews and work down from there.10 To make the list even shorter, you can go ahead and obtain the company quotations, making sure that you are not being ripped off and are actually getting a great deal.

In the end, you will be able to get the highest quality equipment from top-rating companies and at the best prices.

State of Solar in Oregon

Oregon may not really be the first place that comes to mind when you are thinking about top solar states, but did you know that it actually comes in at number 21 when it comes to the ranking of solar power by state?

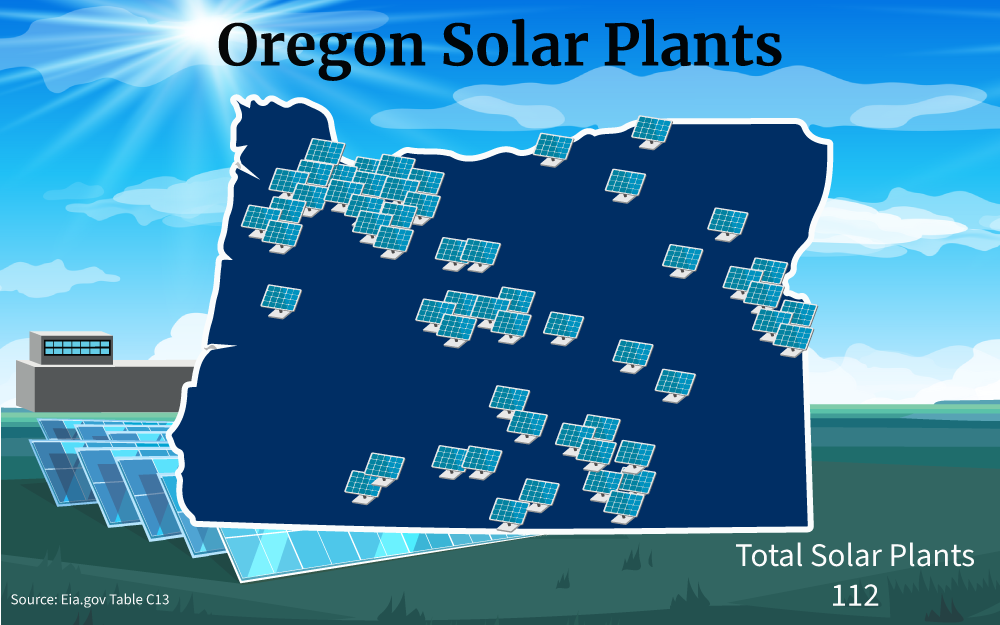

Did you know that 3.26% of power in the state comes from solar? With 1,420MW of solar panel installation Oregon and the ability to power 172,596 homes,4 this puts Oregon in a really great place as a hub for solar power.

Solar power in Oregon is still booming even when there are concerns that it is not exactly one of the sunniest states in the country. You can tell by the presence of over 100 solar manufacturers and installers in the region.

So, if you are considering making the switch to solar power, this may be the perfect time. The numbers are a testament that the state has made major strides to ensure that the market is doing well.

Like many other Oregonians, you have just one problem. Isn’t solar power too expensive?

That was then, over a decade ago before the government launched incentives to cushion the residents making the conversion. Take for instance the solar tax credit.

You can use it to cut down the solar panel cost by thousands and it will all be worth it, not to mention the local Oregon solar programs offered by utilities and municipalities in the region.

Are Solar Panels Worth It in Oregon?

There are so many reasons in favor of going solar that you should probably take into consideration.

First, and perhaps the main reason for many Oregonians is the fact that solar power is the cheaper alternative to grid electricity. It also assures them that at least they will be in charge of generating their own power from their own panels.

Thankfully, the sustainability of solar energy is without question, especially knowing that the solar panels lifespan is 25-30 years, and sometimes even more.

Apart from all the impeccable qualities of solar power, you should also be aware that there are also solar energy problems like pollution, more so after the end of life of the panels. Therefore, if you want to maintain solar energy’s low emission levels, it is best to make sure that you dispose of old panels correctly by taking them to recycling centers in the state.

It is understandable for you to be on the fence when it comes to going solar in Oregon. It is not just about the low rate of sunlight exposure because many people get skeptical about how much the project is going to cost them.

Thankfully, the government solar incentives in Oregon are here to make sure that that doesn’t happen.

Take a look at the federal solar incentive that saves you as much as 30% of your entire solar panel installation cost. This is the most lucrative one yet although there are also other local incentives, Oregon community solar programs, and solar rebates Oregon coming from institutions in the state.

Coupling them together with the solar tax credit makes a huge difference when you are planning to reduce the cost of going solar, especially with the help of Oregon solar incentives.

Frequently Asked Questions About Oregon Solar Incentives

Is There a Statewide Solar Tax Credit in Oregon?

Unfortunately, there is currently no state-specific solar tax credit that is only available for Oregonians. As of now, the only one at your disposal is the federal solar tax credit that is working in all the other states and is the one to take full advantage of.

What Forms Do I Need for Solar Tax Credit in Oregon?

One of the most important solar tax credit forms Oregon that will come in handy during the entire application process of the solar tax credit is the IRS Form 5695. You will have to download it, fill it out correctly, and then submit it together with your taxes of the year, handing everything to the experts for review.

What Happens When the Tax Credit Is Higher Than Your Tax Liability?

There are cases where the 30% awarded to you is more than the tax liability that is available. When that happens, you can rest assured knowing that the balance will be carried forward to the next year for at least five years maximum.

References

1David, L. (2023, August 21).Oregon Solar Tax Credits, Incentives and Rebates (2023). MarketWatch Guides. Retrieved September 1, 2023, from <https://www.marketwatch.com/guides/home-improvement/Oregon-solar-incentives/>

2Hoelzer, B. (2022, October 13). Oregon Net Metering: Here’s How It Works. GreenSavers. Retrieved September 1, 2023, from <https://greensavers.com/articles/oregon-net-metering>

3Rands, A. (2023, August 28). Oregon Solar Incentives (Rebates, Tax Credits & More in 2023). EcoWatch. Retrieved September 1, 2023, from <https://www.ecowatch.com/solar/incentives/or>

4Solar Energy Industries Association. (2023). Oregon Solar. SEIA. Retrieved September 1, 2023, from <https://www.seia.org/state-solar-policy/Oregon-solar>

5Rands, A. (2023, August 28). Solar Panel Cost in Oregon (2023 Local Savings Guide). EcoWatch. Retrieved September 1, 2023, from <https://www.ecowatch.com/solar/panel-cost/or>

6Solar Energy Technologies Office. (2023, March). Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics. Office of Energy Efficiency & Renewable Energy. Retrieved September 4, 2023, from <https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics>

7State of Oregon. (2023, August 29). Oregon Solar + Storage Rebate Program. Oregon.gov. Retrieved September 4, 2023, from <https://www.oregon.gov/energy/Incentives/Pages/Solar-Storage-Rebate-Program.aspx>

8Solar Energy Technologies Office. (2023). Solar Photovoltaic Cell Basics. Office of Energy Efficiency & Renewable Energy. Retrieved September 4, 2023, from <https://www.energy.gov/eere/solar/solar-photovoltaic-cell-basics>

9Shah, C. (2014, May 8). Net Metering [PDF file]. Net Metering. Retrieved September 4, 2023, from <https://www.energy.gov/sites/prod/files/2014/05/f15/fupwg_may2014_net_metering.pdf>

10Wikipedia. (2023, September 4). Solar power. Wikipedia. Retrieved September 4, 2023, from <https://en.wikipedia.org/wiki/Solar_power>

11U.S. Internal Revenue Service. (2022, December 12). Residential Energy Credits. IRS. Retrieved September 4, 2023, from <https://www.irs.gov/pub/irs-pdf/f5695.pdf>

12Energy Sage. (2023, May 15). Solar Panel Cost in Oregon. Energy Sage. Retrieved. September 10, 2023, from <https://www.energysage.com/local-data/solar-panel-cost/or/>

13Energy Trust of Oregon, Inc. (2023). DIY Resources + Cash Incentives. Energy Trust of Oregon. Retrieved September 16, 2023, from <https://www.energytrust.org/residential/incentives/>

14Internal Revenue Service. (2023). Form 1040. IRS. Retrieved September 15, 2023, from <https://www.irs.gov/pub/irs-pdf/f1040.pdf>

15Portland General Electric. (2023). Save Money. Portland General Electric. Retrieved September 15, 2023, from <https://portlandgeneral.com/save-money>

16Pacific Power. (2023). Savings and Choices for Homes. Pacific Power. Retrieved September 15, 2023, from <https://www.pacificpower.net/savings-energy-choices/home.html>

17Oregon Department of Energy. (2023). Oregon Department of Energy Homepage. Oregon.gov. Retrieved September 15, 2023, from <https://www.oregon.gov/energy/Incentives/Pages/default.aspx>

18Photo by Benjamin Jopen. Unsplash. Retrieved from <https://unsplash.com/photos/p2GuLUu79Rg>